Creating a ShopWired Payments account

ShopWired Payments is ShopWired's own secure payment gateway.

You can activate ShopWired Payments if your business is eligible to do so, and receive payments on your ShopWired website via credit/debit card as well as process mail-order or telephone transactions through the ShopWired admin system.

Important notes:

- At this time, ShopWired Payments is only available to individuals (acting as sole traders, partners, etc.) or corporate entities (e.g. limited companies, limited liability partnerships) that reside within the United Kingdom and have a UK bank account

- ShopWired Payments has restrictions on the types of businesses that can use its services, and for what purpose. For more information on these restrictions click here, but generally, ShopWired Payments is suitable for most UK businesses selling standard products and/or services

- If your business is a corporate entity, the owners/directors of the business may be required to provide ShopWired Payments with a personal guarantee for any fees or other types of money that may become owed as a result of chargebacks or fraud. If this is necessary for your business, ShopWired Payments will contact you directly to arrange the personal guarantee after your account has been opened

- ShopWired Payments is operated by ShopWired Payments Limited, which is a separate company to the operator of the ShopWired Ecommerce Platform (the company that provides you with your ShopWired account and website), which is Platform 21 Limited

Schedule of fees

The fees that you pay to use ShopWired Payments are determined by which package you are using for your ShopWired account. However, in certain circumstances (e.g. for high-volume retailers) ShopWired Payments can offer a different rate schedule. Fees are payable for each transaction you receive on your account, as well as for chargebacks/reversals/disputes and if you use the instant payout feature to receive your transaction funds quicker.

| Card type | Fees |

|---|---|

| Standard/Consumer UK Cards | 1.5% +20p ¹ |

| Business/Premium UK Cards | 2.2% +20p |

| EU Debit/Credit Cards | 2.5% +20p |

| International Debit/Credit Cards | 3.25% +20p |

| American Express | 3.0% +20p |

| Payout Frequency | Daily |

| Payout Cost | Free of charge |

| Disputes | £20 ² |

¹ ShopWired accounts on the ShopWired Essentials package will pay 1.9% +20p per transaction for UK consumer cards. All other ShopWired accounts will pay 1.5% +20p per transaction for UK consumer cards.

² A dispute fee is charged if a transaction on your account is subject to a dispute/chargeback by the cardholder's issuing bank. Disputes are managed from within your ShopWired account for you to either accept or defend. Unfortunately, due to costs imposed on ShopWired Payments by card networks and banks, dispute fees are not returned.

Opening your account

Opening your account

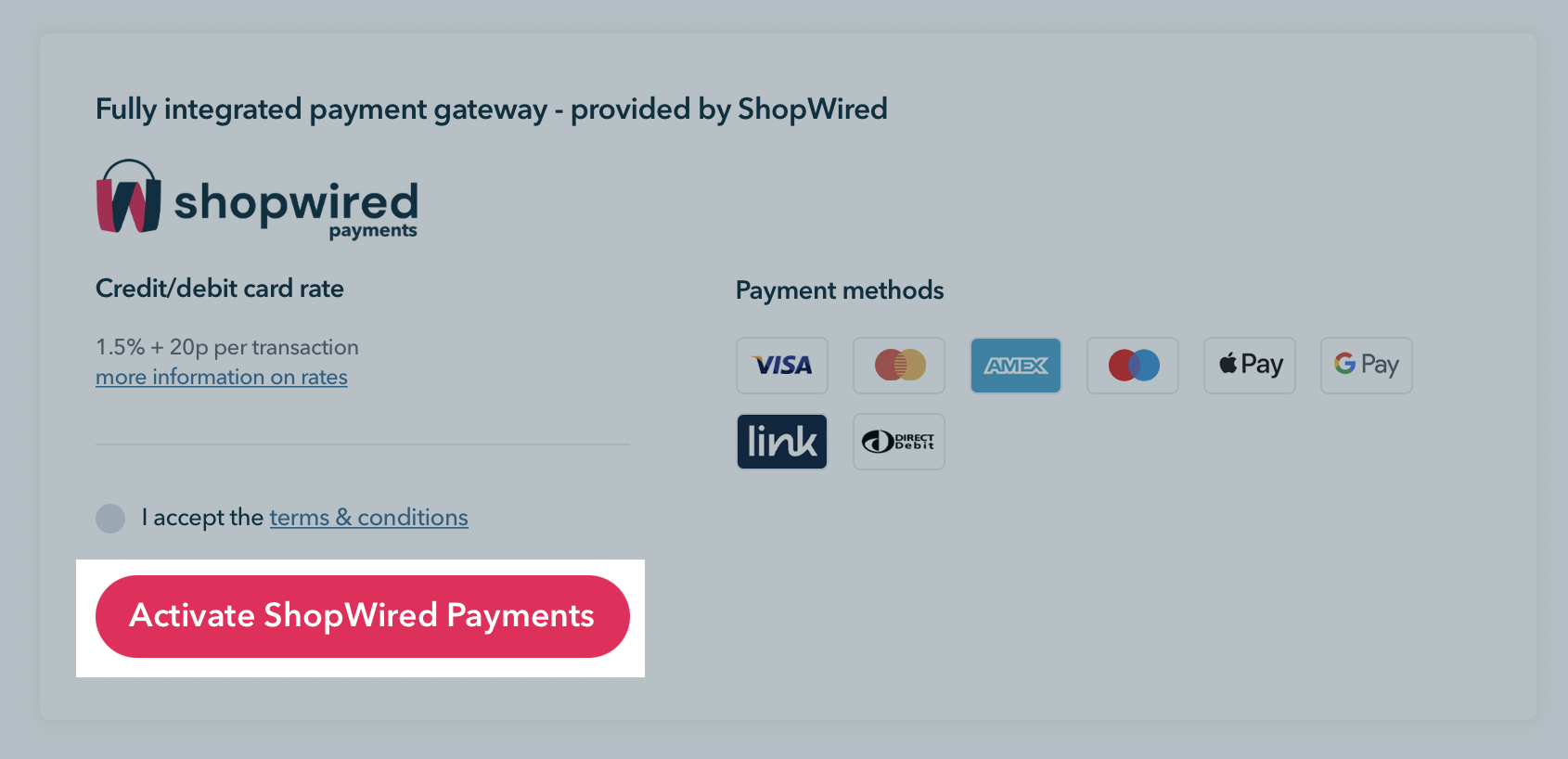

Once you have checked that your business is eligible to open an account with ShopWired Payments you can do so easily through the payment gateways page of your ShopWired account. Click the 'activate ShopWired payments' button to get started and the onboarding flow will start.

ShopWired Payments is powered by Stripe, one of the world's leading payment platforms, and Stripe performs the onboarding and identity verification process on behalf of ShopWired Payments. As part of the onboarding process, you'll be asked a range of questions about you/your business such as the legal company name, address and the details of any owners of the business.

Stripe may ask for additional identity documents or verification during or after the onboarding process, and you will need to answer any questions asked promptly.

Account status

Account status

If you have provided all the necessary information that we require to allow you to process transactions and receive payouts, your customers will be able to start using ShopWired Payments immediately.

If we, or our partners, require more information from you, you will be notified within your account dashboard.

Once your account is open, you can begin configuring the settings of your ShopWired Payments account.

Required information and documents

Required information and documents

To comply with relevant legislation, card network rules and regulations, and ShopWired Payments' own risk and underwriting procedures, we're required to collect certain information from you during the account onboarding process. In addition, we'll need to confirm your identity.

The exact information and identity documents we'll ask for depends on your type of business (for example, if you're operating from a limited company or as a sole trader).

Below, we provide a brief outline of the information that you'll be asked to provide when creating your ShopWired Payments account. We'd advise that you prepare all of this information before starting the onboarding process to ensure that it can be completed smoothly.

Account information

You'll be asked to provide:

- Your type of business (e.g. limited company, sole trader, partnership)

- Your website URL

Company information

You'll be asked to provide:

- Company name

- Company address and phone number

- Any tax ID (e.g. VAT registration number)

- Names of all directors, beneficial owners and any other executives

Representative information

For each named representative of the company, you'll be asked to provide:

- Name

- Address

- Date of birth

- Email address and phone number

- Relationship to the company

- Photo ID (e.g. passport, driving licence) - not always required

Company directors/owners

For each company director and/or beneficial owner of the company, you'll be asked to provide:

- Name

- Address

- Date of birth

- Email address and phone number

- Relationship to the company

- Photo ID (e.g. passport, driving licence) - not always required

- Proof of address (e.g. bank statement, credit card statement, utility bill) - not always required

Company directors and beneficial owners

For limited (LTD) or public limited (PLC) companies, information on all directors will be requested.

You may be requested to supply Photo ID and Proof of address identity documents for company directors and beneficial owners if we can't verify the provided information automatically or if there are concerns about sanctions.

Proof of address (e.g. bank statement, credit card statement, utility bill) - not always required