Landed cost calculator

The Landed cost calculator app allows you to calculate and, where required, collect customs & duties on orders delivered to the United States, Puerto Rico, and U.S. Virgin Islands. Customs & duties can either be calculated under the PDDP or DDP schemes.

The duties are calculated and can be included in the order total, offered as an option for customers to prepay, or displayed for acknowledgement only.

To install the app:

- Navigate to Apps

- Locate the Landed cost calculator app

- Select

install this app

About customs & duties

When goods are imported into the United States from overseas, they may be subject to a range of charges collected by U.S. Customs and Border Protection. These charges can include:

- Customs duties (based on the product’s classification and origin)

- Merchandise processing fees, harbour maintenance fees (for sea freight)

- Tariffs (broad trade measures that may apply on top of normal duties)

- And in some cases, other import-related taxes

The Landed Cost Calculator app calculates estimates for these costs and, depending on your settings, can either add them to the order total or display them at checkout for the customer to acknowledge. Depending on whether you are shipping into the United States customs territory using a postal carrier or a courier, customs & duties are calculated either using a third party duty engine or from the tariff set by the US Government.

Customs & duties only apply to imports into the United States, Puerto Rico, and U.S. Virgin Islands. They do not apply to other U.S. territories such as Guam, American Samoa, or the Northern Mariana Islands. Orders shipped to these locations will not be subject to calculation by the landed cost calculator.

Duty prepayment methods: DDP vs PDDP

When using the Landed cost calculator, there are two ways for customs & duties to be handled:

Delivered Duty Paid (DDP)

- ShopWired uses a third-party duty engine to calculate duties based on product HS codes and countries of origin

- Duties may include customs charges, tariffs, and other fees depending on the classification and origin

- Appropriate when using a courier company, i.e. not a postal service, for delivery

Postal Delivered Duty Paid (PDDP)

- Duties are calculated internally by ShopWired using a fixed tariff percentage based on the product’s country of origin and its value

- HS codes and countries of origin are still required

- Appropriate when using a postal carrier, e.g. Royal Mail, for delivery

- Used when postal carriers such as Royal Mail handle customs in a simplified way

Choosing the method

- Each delivery rate can be configured to use either

No prepayment,DDP, orPDDP - The method selected for the delivery rate determines how customs & duties are calculated

App settings

App settings

To manage the app's settings, navigate to Checkout > Landed cost calculator.

Landed cost calculator enabled

Use the toggle to turn the Landed cost calculator app on or off. When this setting is deselected, no customs & duties are calculated or displayed at checkout and no charges are applied to orders.

Collection requirement

Control how customers interact with customs & duties:

Mandatory– the calculated amount is always included in the order total when the delivery rate supports DDP or PDDP- Customers must pay the customs & duties when placing their order

Optional– visitors can choose to prepay customs & duties using a checkbox at checkoutDisplay only– the customs & duties amount is shown for information only- Customers cannot prepay but must acknowledge responsibility for paying themselves

Other delivery charges

Use this setting to select how customs & duties should be handled for visitors with orders that do not contain a standard delivery rate, i.e. the order only contains products which have specific delivery pricing or wholesale delivery is applied to their order.

Neither DDP or PDDP should be used- visitors will not be able to prepay customs & duties at checkoutDDP should be used- visitors' orders will be treated in the same way as delivery rates that are enabled for DDPPDDP should be used- visitors' orders will be treated in the same way as delivery rates that are enabled for PDDP

Uplifts

Uplifts allow you to adjust the calculated customs & duties by adding extra amounts on top of the base figure returned by the duty calculation. They are useful if you want to recover additional costs associated with managing imports or if you need to build in an overhead margin.

- Uplifts are added after the base customs & duties amount is calculated

- Customers see the uplift included within the total

Customs & dutiesline at checkout - In ShopWired’s integrations with apps such as accounting or shipping platforms, uplifts are returned separately so that only the base customs & duties are sent as part of the duty calculation

Percentage uplift

Use this setting to increase the calculated customs & duties by a percentage value (0–100, up to two decimal places). For example, if the duty engine calculates £20 and you set a 5% uplift, the final amount shown to the customer will be £21.

Fixed uplift

Use this setting to add a fixed currency amount to the calculated customs & duties (e.g. £1.50). Like the percentage uplift, this amount is shown to customers as part of the Customs & duties line but is stored separately from the base calculation in exports and integrations.

Delivery rate settings

Delivery rate settings

When using the Landed cost calculator, you can choose whether a delivery rate supports Delivered Duty Paid (DDP), Postal Delivered Duty Paid (PDDP) or Neither. This controls whether customs & duties can be prepaid by the visitor as part of the order total and how the customs & duties are calculated.

- If a delivery rate is marked as

Delivery rate supports DDP, visitors can prepay customs & duties depending on your app settings - customs & duties are calculated using a third party duty engine - To calculate the customs & duties the duty engine uses the product's price, HS code and country of origin

- If a delivery rate is marked as

Delivery rate supports PDDP, visitors can prepay customs & duties depending on your app settings - To calculate the customs & duties ShopWired uses the product's price, country of origin and tariff for that country of origin

- If a delivery rate is marked as

No duty prepayment, the customs & duties amount is still displayed at checkout, but visitors cannot select to prepay and must acknowledge responsibility instead - Customs & duties are calculated using the DDP scheme

- If you have configured the Collection requirement for customs & duties to be

mandatorythen visitors will still be unable to prepay customs & duties if their selected delivery rate is not marked as supporting DDP or PDDP

Creating / editing delivery rates

When creating or editing a delivery rate, select the Landed shipping costs tab and select a value for the Duty prepayment method setting if the delivery rate allows customers to prepay landed shipping costs.

Delivery rate import system

When importing delivery rates through the delivery rate import system, in the Duty Prepayment Method column enter either DDP, PDDP or No.

Product settings

Product settings

For the Landed cost calculator to be able to calculate the customs & duties, every product in the visitor's basket must have both an HS code and a Country of origin. Both items of data are required irrespective of the customs & duties calculation method.

- The HS code (Harmonised System code) identifies the type of goods being shipped and determines the applicable duty rate

- The Country of origin specifies where the product was manufactured or produced, which is also used to determine duty rates

If either value is missing for a product, customs & duties cannot be calculated for the order.

An additional setting on products can be specified separately and will be used in place of the HS Code where set, but only for DDP customs & duties calculations.

Creating / editing products

When creating or editing a product, navigate to the Additional information section and in the Product identifiers tab enter the HS code and select the Country of origin from the dropdown list.

Product import system

When using the product import system, use the columns HS Tariff Code and Country Of Origin.

The country of origin must be entered as the full country name (for example, United Kingdom) using the same format available in the dropdown list on the product page.

Product extras

Product extras

Product extras are treated as separate line items when calculating customs & duties, provided they are linked to a product that has its own SKU code. For customs & duties to be calculated on a product with extras, both the parent product and all linked extras must have an HS code and a Country of origin.

- If all linked extras and the parent product include valid HS codes and countries of origin, each extra is sent as a separate line item at its configured price

- The parent product’s value is reduced accordingly so that the combined values always match the basket line total

- If any linked extra or the parent product is missing an HS code or a Country of origin, the entire line (the parent product and its extras) is excluded from duty calculations

Product bundles

Product bundles

Product bundles are treated as a collection of their constituent products when calculating customs & duties. For duties to be calculated correctly, each constituent product in the bundle must have an HS code, a Country of origin, and a value entered for the Percentage price contribution setting.

How percentage price contribution works

The Percentage price contribution setting determines how the bundle price is divided across its constituent products. Each percentage allocates part of the bundle’s total price to a specific product, which is then used to calculate its customs & duties value.

For example, if a bundle costs £2,000 and contains:

- Product A, quantity 3, with a 30% price contribution

- Product B, quantity 1, with a 70% price contribution

The calculation is:

- Product A contributes £600 (30% of £2,000), which divided by 3 units equals £200 per unit

- Product B contributes £1,400 (70% of £2,000), which equals £1,400 per unit

These apportioned unit prices are the values sent to the duty engine for customs & duties calculations.

Percentage price contribution

The Percentage price contribution determines how much of the bundle’s price is attributed to each constituent product. This allows the Landed cost calculator to work out an accurate unit price for each item in the bundle.

- If the percentages across all constituent products add up to 100, each product is sent as a separate line item with the correct apportioned value

- If the percentages do not add up to 100, the entire bundle is excluded from duty calculations

Creating / editing product bundles

When creating or editing a product bundle:

- Enter the HS code and select the Country of origin for each constituent of the bundle

- Specify the Percentage price contribution for each constituent product on the product bundle

- The percentages across all constituents must total 100

Importing product bundles

When using the product import system:

- Specify the Percentage price contribution for each constituent product by adding it after the SKU and quantity in the

Bundle Productscolumn - Separate with a pipe (

|) - For example,

SKU124 x 3 | 6means SKUSKU124has a quantity of 6 in the bundle and contributes 60% of the bundle price

| Item ID | Bundle | Bundle Products | Bundle Title | Bundle Image |

|---|---|---|---|---|

| 123456 | Yes | SKU123 x 1 | 40 , SKU124 x 3 | 60 |

Checkout customisation settings

Checkout customisation settings

In the checkout customisation settings, the Landed cost calculator section allows you to customise the text displayed to visitors when customs & duties apply. These settings determine the information shown. In some cases, the text is accompanied by a checkbox is displayed that the visitor must select before they can continue with checkout.

Text shown when duties/taxes are always included in the order total

The text in this setting is used when customs & duties are mandatory and included in the order total. This text is displayed without a checkbox.

The default text is:

Import duties and customs fees are included in your order total. You will not be charged any additional amounts on delivery.Text shown when the visitor can choose whether to prepay duties/taxes

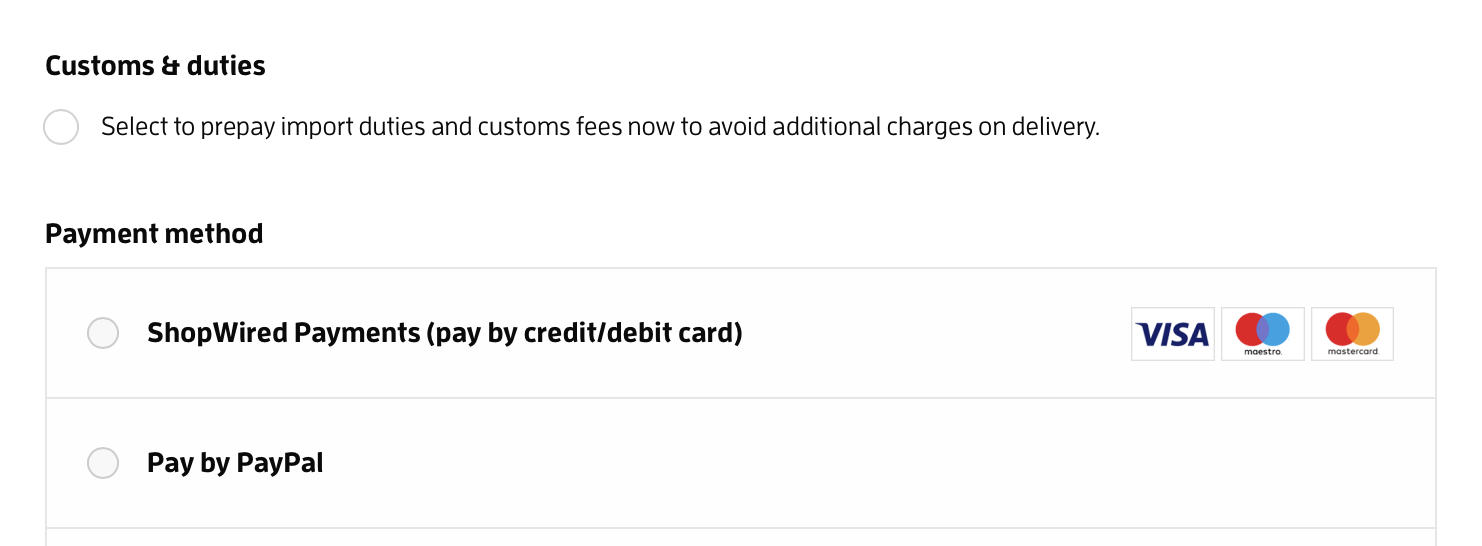

The text in this setting is used when customs & duties are optional and visitors can decide whether to prepay. This text is displayed alongside a checkbox that visitors can choose to select to prepay duties.

The default text is:

Select to prepay import duties and customs fees now to avoid additional charges on delivery.Text shown when duties/taxes are not collected

The text in this setting is used when customs & duties are displayed for acknowledgement only and cannot be prepaid. This text is displayed with a mandatory acknowledgement checkbox.

The default text is:

Import duties and customs fees are not included in your order total. I acknowledge responsibility for paying these charges directly to the courier before my order is delivered.Text shown when duties/taxes cannot be calculated

The text in this setting is used when customs & duties cannot be calculated (for example, missing HS codes and countries of origin, or issues with the duty engine). This text is displayed with a mandatory acknowledgement checkbox.

The default text is:

Import duties and customs fees are not included in your order total and we are currently unable to calculate them. I acknowledge responsibility for paying these charges directly to the courier before my order is delivered.Checkout behaviour

Checkout behaviour

When the Landed cost calculator app is enabled, a Customs & duties section appears during checkout if the visitor’s delivery address is in the United States, Puerto Rico, or U.S. Virgin Islands. The text displayed, whether a checkbox is required, and whether the amount is included in the order total depend on your configuration and the delivery rate selected by the visitor.

In all cases where a checkbox is shown, it must be selected by the visitor before they can continue with checkout.

Display in the order summary

- When duties are prepaid (mandatory or optional with the checkbox ticked), the

Customs & dutiesline appears in the order summary above the grand total and is included in the total amount charged. - When duties are not prepaid (optional not ticked, or display only), the

Customs & dutiesline appears beneath the grand total and is not included in the total amount charged.

Scenarios

| App enabled | Delivery rate supports DDP/PDDP | Collection requirement | Message shown | Duties added to grand total | Checkbox required |

|---|---|---|---|---|---|

| Yes | Yes | Mandatory | Text shown when duties/taxes are always included in the order total | Yes | No |

| Yes | Yes | Optional | Text shown when the visitor can choose whether to prepay duties/taxes | Yes, if checkbox ticked | Yes |

| Yes | Yes | Display only | Text shown when duties/taxes are not collected | No | Yes |

| Yes | No | Mandatory | Text shown when duties/taxes are not collected | No | Yes |

| Yes | No | Optional | Text shown when duties/taxes are not collected | No | Yes |

| Yes | No | Display only | Text shown when duties/taxes are not collected | No | Yes |

| Yes | Any | Any (missing HS code or origin) | Text shown when duties/taxes cannot be calculated | No | Yes |

Admin orders

Admin orders

When creating or editing an order manually in admin, customs & duties are handled in a similar way to checkout but with some differences in how they are applied.

- A

calculate taxesoption is available on the order creation page - Selecting this option will calculate the customs & duties for the order

- After calculation, the Customs & duties amount will be shown in the order summary

- If the collection requirement is set to Mandatory, the amount is automatically included in the grand total

- If the collection requirement is set to Optional or Display only, a Duties option allows you to choose whether the duties should be prepaid (

Pre-paid) or not (Not paid) - This option replaces the customer-facing checkbox shown during checkout

Once the order is created, customs & duties are recorded on the order in the same way as website orders and, where prepaid, are displayed in the order totals above the grand total.

Viewing orders

Viewing orders

When an order includes customs & duties, a Customs & duties section is shown when viewing the order within your ShopWired account. This section provides a breakdown of how the amount was calculated and additional information that can help you understand or troubleshoot the result.

The following values can be shown:

- Calculated customs & duties shows the amount returned by either by the duty engine or ShopWired's tariff table, before any uplifts are applied

- Total uplift applied shows the combined total of percentage and fixed uplifts configured in your account

- Final customs & duties shows the total amount shown to the customer at checkout (calculated duties + uplifts)

- Added to grand total indicates whether the final customs & duties were included in the order’s grand total (applies when duties are prepaid or mandatory)

- Customer acknowledgement given shows whether the customer confirmed responsibility for duties by ticking a checkbox during checkout

- Customs & duties prepaid shows whether the customer prepaid the duties (Yes/No)

- Collection requirement shows which collection requirement applied at the time of checkout (Mandatory, Optional, or Display only)

- Acknowledgement required shows whether the customer was required to acknowledge responsibility for duties at checkout

- Delivery rate support shows either

None,PDDPorDDPdepending on whether the selected delivery rate was marked as supporting DDP, PDDP or No prepayment - Products valid confirms whether all products in the order had the required HS codes and countries of origin to allow duty calculation

In addition, the section includes view logs which open detailed records in a modal window:

- Checkout text shown to customer shows the exact wording that appeared at checkout, including any acknowledgement text or instructions

- API request log shows the information sent to the duty engine, including shipping details and product data used for the calculation

- API response log shows the calculation returned by the duty engine, including the duty amount, any additional charges, and calculation notes

- Product details log shows the product information that was processed for the calculation, including identifiers and line item values

These logs are provided to help you diagnose why a particular calculation was made, or why duties may not have been calculated.

Orders & exports

Orders & exports

When an order is completed, customs & duties are stored with the order and displayed throughout your ShopWired account.

Order page

- On the order page in admin, the Customs & duties amount is shown above the grand total if the duties were prepaid or mandatory

- If the duties were not prepaid, the amount is shown in the Customs & duties section of the order instead, along with details of the calculation and acknowledgement status.

Orders CSV export & feeds

- The Orders CSV export and order feeds include additional columns when at least one order contains customs & duties:

- Customs & Duties shows the calculated amount (including any uplift)

- Customs & Duties Uplift shows the uplift value applied

- DDP/PDDP shows either

DDP,PDDPorNo, depending on whether the customer prepaid the duties and the delivery rate was configured for DDP or PDDP - SW LCC Fee shows the usage fee charged for the order by ShopWired

API & webhooks

- The order API and webhooks include a

customsAndDutiesobject with three properties: amountreturns the customs & duties calculated (before uplifts)upliftAmountreturns the total uplift appliedtotalAmountreturns the final amount shown to the customer

Twig objects

Twig objects

The order.customs_and_duties Twig object can be used to output customs & duties amounts in theme templates. This object contains the following properties:

order.customs_and_duties.amountreturns the amount of customs & duties calculated before any uplifts are appliedorder.customs_and_duties.paidreturnstrueif the customer pre-paid the customs & dutiesorder.customs_and_duties.uplift_amountreturns the total uplift value (percentage + fixed) applied to the calculated amountorder.customs_and_duties.total_amountreturns the final amount displayed to the customer at checkout (the sum of the base amount and the uplift)order.customs_and_duties.typereturns eitherddporpddpdepending on the customs & duties calculation type

These properties allow you to display the duties separately or as part of the order summary in customised theme designs.

Order invoices

Order invoices

Each ShopWired order invoice PDF theme is unique to the account that it is installed in. When the Landed cost calculator app is installed, your order invoice PDF theme will not automatically display customs & duties.

You can follow the instructions about HTML customisations to invoice PDF themes to adjust your invoice PDF theme to display the amount of customs & duties for an order or contact theme support for assistance.

Formal theme

If you are using the Formal theme and want to add the total amount of customs & duties, including any uplift, as a single line item you can add the code shown below above the grand total (around line 350).

{% if order.customs_and_duties.total_amount %}

<tr>

<td>

CUSTOMS & DUTIES

</td>

<td class="textright">

{{ format_price(order.customs_and_duties.total_amount) }}

</td>

</tr>

{% endif %}

Standard theme

If you are using the Standard theme and want to add the total amount of customs & duties, including any uplift, as a single line item you can add the code shown below above the grand total (around line 350).

{% if order.customs_and_duties.total_amount %}

<tr>

<td class="titlecolor">

<strong>CUSTOMS & DUTIES</strong>

</td>

<td class="textright">

<b>{{ format_price(order.customs_and_duties.total_amount) }}</b>

</td>

</tr>

{% endif %}

Basic theme

If you are using the Basic theme and want to add the total amount of customs & duties, including any uplift, as a single line item you can add the code shown below above the grand total (around line 180).

{% if order.customs_and_duties.total_amount %}

<tr class="total">

<td colspan="4"><b>Customs & duties</b></td>

<td>{{ format_price(order.customs_and_duties.total_amount) }}

</tr>

{% endif %}

Billing & fees

Billing & fees

DDP calculations

No monthly fee or per-order fee will ever be charged for DDP calculations.

PDDP calculations

No monthly fee or per-order fee will ever be charged for PDDP calculations.

PDDP tariffs & product exemptions (US imports)

PDDP tariffs & product exemptions (US imports)

ShopWired uses the tariff schedule below for calculating the tariff applied to a product, depending on its selected country of origin, when the visitor's selected delivery rate is configured for PDDP.

Last updated, 2nd March 2026.

| Country | Tariff % |

|---|---|

| Afghanistan | 10 |

| Algeria | 10 |

| Angola | 10 |

| Bangladesh | 10 |

| Bosnia and Herzegovina | 10 |

| Botswana | 10 |

| Brunei | 10 |

| Cambodia | 10 |

| Cameroon | 10 |

| Chad | 10 |

| China (incl. HK, Macao) | 10 |

| Côte d’Ivoire | 10 |

| Democratic Rep. of Congo | 10 |

| Equatorial Guinea | 10 |

| European Union | 10 |

| Falkland Islands | 10 |

| Fiji | 10 |

| Guyana | 10 |

| India | 10 |

| Indonesia | 10 |

| Iraq | 10 |

| Israel | 10 |

| Japan | 10 |

| Jordan | 10 |

| Kazakhstan | 10 |

| Laos | 10 |

| Lesotho | 10 |

| Libya | 10 |

| Liechtenstein | 10 |

| Madagascar | 10 |

| Malawi | 10 |

| Malaysia | 10 |

| Mauritius | 10 |

| Moldova | 10 |

| Mozambique | 10 |

| Myanmar (Burma) | 10 |

| Namibia | 10 |

| Nauru | 10 |

| Nicaragua | 10 |

| Nigeria | 10 |

| North Macedonia | 10 |

| Norway | 10 |

| Pakistan | 10 |

| Papua New Guinea | 10 |

| Philippines | 10 |

| Serbia | 10 |

| South Africa | 10 |

| South Korea | 10 |

| Sri Lanka | 10 |

| Switzerland | 10 |

| Syria | 10 |

| Taiwan | 10 |

| Thailand | 10 |

| Tunisia | 10 |

| Vanuatu | 10 |

| Venezuela | 10 |

| Vietnam | 10 |

| Zambia | 10 |

| Zimbabwe | 10 |

| United Kingdom | 10 |

| All other countries (default) | 10 |

When using PDDP, some products are automatically exempt from customs & duties. These exemptions are based on the product’s HS code. If a product is exempt, it will not be included in the duty calculation, even if it has a valid country of origin.

The following HS codes are always excluded from PDDP calculations:

- Any HS code starting with:

9701– Paintings, drawings and pastels9702– Original engravings, prints and lithographs9703– Original sculptures and statuary9704– Postage or revenue stamps, stamp-impressed paper, first-day covers, etc.9705– Collections and collectors’ pieces of zoological, botanical, mineralogical, historical, archaeological, palaeontological, ethnographic or numismatic interest9706– Antiques more than 100 years old4901– Printed books, brochures, leaflets4902– Newspapers, journals and periodicals4903– Children’s picture books and colouring books4904– Music, printed or in manuscript form4905– Maps and hydrographic or similar charts- Specific HS codes that are also exempt:

4911.10.00– Trade advertising material, commercial catalogues and the like4911.91.10– Pictures, designs and photographs

The above items are recognised as cultural works, antiques, or printed material, and under U.S. customs rules they do not attract import duties. To ensure accuracy, ShopWired automatically excludes them from PDDP duty calculations.

- Any HS code starting with:

7206– Iron and non-alloy steel in ingots or other primary forms7207– Semi-finished products of iron or non-alloy steel7208– Flat-rolled products of iron or non-alloy steel, ≥600mm wide, hot-rolled7209– Flat-rolled products of iron or non-alloy steel, ≥600mm wide, cold-rolled7210– Flat-rolled products of iron or non-alloy steel, ≥600mm wide, clad/plated/coated7211– Flat-rolled products of iron or non-alloy steel, <600mm wide7212– Flat-rolled products of iron or non-alloy steel, <600mm wide, clad/plated/coated7213– Bars and rods, hot-rolled, in irregularly wound coils7214– Bars and rods, of iron or non-alloy steel, not in coils7215– Other bars and rods of iron or non-alloy steel7216– Angles, shapes and sections of iron or non-alloy steel7217– Wire of iron or non-alloy steel7218– Stainless steel in ingots or other primary forms7219– Flat-rolled products of stainless steel, ≥600mm wide7220– Flat-rolled products of stainless steel, <600mm wide7221– Bars and rods, of stainless steel, hot-rolled, in irregularly wound coils7222– Other bars and rods of stainless steel; angles, shapes, sections7223– Wire of stainless steel7224– Alloy steel in ingots or other primary forms7225– Flat-rolled products of alloy steel, ≥600mm wide7226– Flat-rolled products of alloy steel, <600mm wide7227– Bars and rods, of alloy steel, hot-rolled, in irregularly wound coils7228– Other bars and rods of alloy steel; hollow drill bars; angles, shapes, sections7229– Wire of alloy steel7301– Sheet piling, welded angles, shapes and sections of iron or steel7302– Railway or tramway track construction material of iron or steel7304– Tubes, pipes and hollow profiles, seamless, of iron or steel7305– Other tubes and pipes (e.g. welded), >406.4mm external diameter7306– Other tubes, pipes and hollow profiles of iron or steel7315– Chain and parts thereof, of iron or steel7316– Anchors, rivets, bolts, nuts, screws, washers, etc., of iron or steel7317– Nails, tacks, staples, corrugated nails, etc., of iron or steel

All HS codes listed above beginning with 72, 73, 7315, 7316 or 7317 fall within the scope of U.S. Section 232 steel measures. Under normal U.S. customs law these products attract additional tariffs (50% for most countries of origin, 25% for UK until 9 July 2025, plus possible Section 301 duties for Chinese origin). However, when imported via postal carriers under the IEEPA reciprocal tariff system, Section 232 products are specifically excluded from the duty tables. As a result, Royal Mail and other postal operators treat these items as duty-free under PDDP, apart from their handling charge. For accuracy, ShopWired’s PDDP calculations automatically exclude these HS codes, even though they are not truly duty-free if shipped under a courier/DDP method.

Limitations

Limitations

The Landed cost calculator cannot always be used.

There are specific scenarios where customs & duties will not be calculated, and visitors will instead see the fallback acknowledgement text at checkout.

- All products in the basket must have both an HS code and a Country of origin

- If any product, product extra, or bundle constituent is missing these values, customs & duties cannot be calculated for the order

- If bundle products are used, the Percentage price contribution for each constituent must be set and must add up to 100; otherwise the bundle is invalid and duties cannot be calculated

- Digital products are excluded from duty calculations

- Gift vouchers are excluded from duty calculations

- If any invalid items are present in the basket, the calculator will not attempt to calculate duties for any part of the order

Express checkout availability

When the Landed cost calculator is enabled, express checkout methods (e.g. PayPal on the basket page) may be unavailable if shipping details are required to calculate import taxes but cannot be collected before payment.

If a product is configured so that a delivery address is not required, express checkout can still be shown, but no import taxes will be calculated because no delivery country is available.